- Best cryptocurrency to invest in 2025

- Cryptocurrency market trends february 2025

- Cryptocurrency market trends march 2025

Cryptocurrency market news april 2025

Broader market trends may heavily influence the price performance of NEAR. First and foremost, institutional adoption will be pivotal in driving demand for NEAR https://citasca.com/. This interest from institutions is a pre-requisite for NEAR to move to our higher target, but also potentially exceed it and move well beyond $7 in 2025.

Throughout March, the crypto market continued its pullback from February, driven by macroeconomic uncertainty and policy changes in the United States. Amid this negative market sentiment, the sector witnessed some notable developments, which have been outlined by the research arm of the world’s largest crypto exchange, Binance.

Regulatory clarity and market acceptance will be crucial for XRP to reach the higher end of this spectrum. The expected positive resolution of the battle between Ripple and the SEC is clearly positively impact its trajectory.

Best cryptocurrency to invest in 2025

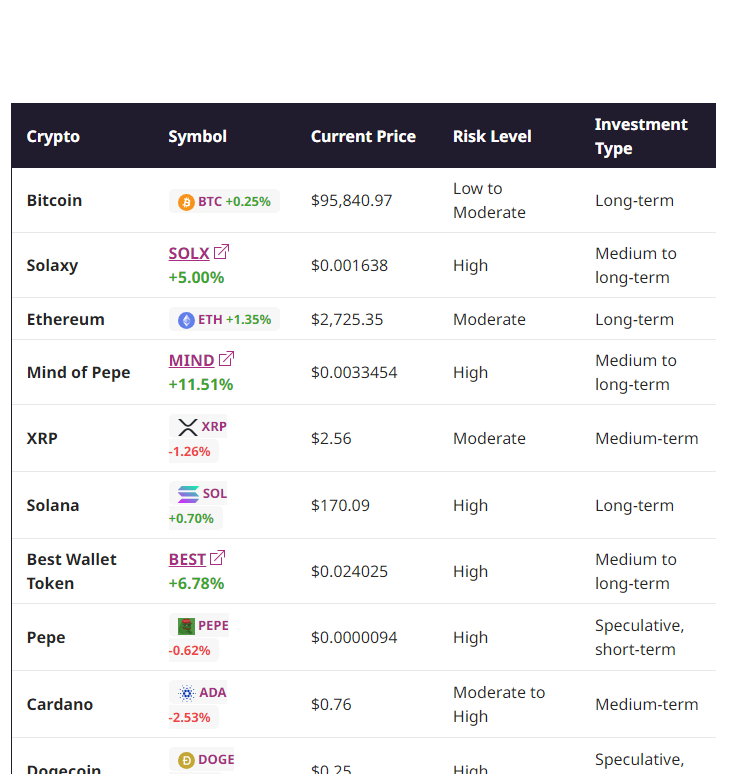

Several cryptos have a high potential to increase in value in 2025. These include Bitcoin, Ethereum, Solana, Dogecoin, Cardano, Solana, XRP, , and Binance Coin (BNB). These coins have gained traction due to their innovative technology and potential use cases. Additionally, these coins are backed by strong development teams and have the potential to become major players in the cryptocurrency space.

Several cryptos have a high potential to increase in value in 2025. These include Bitcoin, Ethereum, Solana, Dogecoin, Cardano, Solana, XRP, , and Binance Coin (BNB). These coins have gained traction due to their innovative technology and potential use cases. Additionally, these coins are backed by strong development teams and have the potential to become major players in the cryptocurrency space.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Cryptocurrency prices have fluctuated widely so far this year, leaving some investors with notable gains and others with losses. But crypto is a notoriously risky investment and prices can skyrocket or plummet in a matter of days or minutes. Keeping an eye out for the top performers every now and then can give you important context on how the market is performing.

The most profitable crypto investment in 2023 will depend on the market conditions and your risk tolerance. However, some of the potentially profitable cryptos include Bitcoin, Ethereum, Cardano, Solana, and others. Doing your own research and understanding the risks associated with investing in cryptocurrencies is important.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

Cryptocurrency market trends february 2025

Ethereum staking rate will exceed 50%. The Trump administration is likely to offer greater regulatory clarity and guidance for the crypto industry in the U.S. Among other outcomes, spot-based ETH ETPs will likely be allowed to stake some percentage of the ETH they hold on behalf of shareholders. Demand for staking will continue to rise next year and likely exceed half of Ethereum circulating supply by the end of 2025, which will prompt Ethereum developers to more seriously consider changes to network monetary policy. More importantly, the rise in staking will fuel greater demand and value flowing through Ethereum staking pools like Lido and Coinbase and restaking protocols like EigenLayer and Symbiotic. -Christine Kim

However, this momentum slowed in late January after DeepSeek’s AI model development raised concerns about the overvaluation of U.S. tech stocks, leading to a market-wide sell-off that affected both traditional finance and digital assets.

Bitcoin will again be among the top performers on a risk-adjusted basis among global assets in 2025. The AUM comparison above is due to both record inflows and Bitcoin price appreciation throughout 2024. Indeed, Bitcoin is the 3rd best-performing asset on a risk-adjusted basis compared to a basket of equities, fixed-income securities, indices, and commodities. Notably, the best Sharpe ratio belongs to MicroStrategy, a self-described “bitcoin treasury company.” -Alex Thorn

Introduction Blockchain technology is transforming various sectors, from finance to healthcare and beyond. But what exactly is blockchain programming, and why is it so important? If you’ve ever wondered how…

Cryptocurrency market trends march 2025

Breaking above the Fibonacci level of $14.04 could signal a bullish reversal in $DOT, with significant growth potential. Support levels around $3.55 will be important for maintaining a positive trend.

As we begin 2025, the memecoin craze shows no signs of slowing down. Fueled by the emergence of politically-endorsed coins – such as $Melania, $Trump, and $LIBRA – these once joke tokens are gaining ground in growth. New memecoins are constantly emerging, often riding waves of viral popularity. Memecoins are introducing a new generation of cryptocurrencies and expanding the market beyond traditional investors.

Ethereum’s analysis by Glassnode highlights a potential stabilization at the $1,886 level, despite its weakening position against Bitcoin. This could indicate a consolidation phase before any significant upward movement. The upcoming Pectra upgrade and the growing interest in tokenized assets could further influence Ethereum’s market.

The crucial Fibonacci level of $0.00012 will be significant for SHIB bullish momentum. Continued development and community support will be key drivers, alongside potential integrations and partnerships.

As more creators turn to platforms like Render, we can expect to see a proliferation of niche cryptocurrencies tied to specific fandoms, brands, or personalities. These creator coins could fundamentally reshape the entertainment landscape, providing new revenue streams for artists and allowing fans to invest in their favorite creators directly. By 2025, the lines between content creation, fandom, and cryptocurrency investment may be increasingly blurred.